Recycling of office space? Renegotiations, subleases, reconstruction or serviced offices are a current trend

29 February 2024

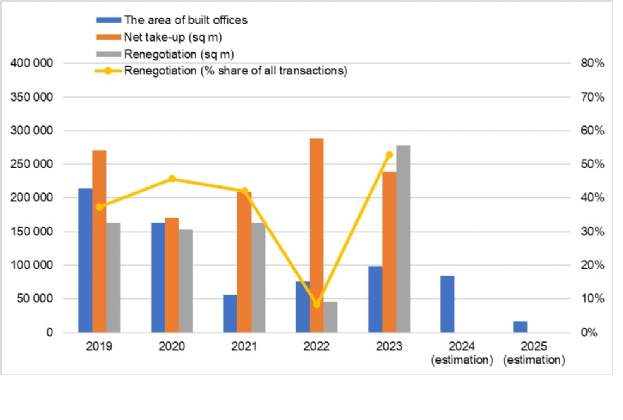

In the fourth quarter of 2023, renegotiations and contract renewals accounted for 60% of the total transaction volume, equivalent to 100,100 sq m out of 166,700 sq m."The increase reflects the current market dynamics, where the scarcity of new office constructions results in reduced available space. In many cases, this forces companies to look for a temporary solution. Companies can postpone plans to move, but sooner or later they will have to take the step. We have to keep in mind that not all buildings can be upgraded to meet today's growing needs, such as charging stations for electric vehicles," comments Pavel Novák, Head of Office Agency at Savills.

Subleases

Secondary supply of office space, that is supply from companies offering their leased but unused space for sublease, has increased in Prague, reaching 60,200 sq m by the end of the year. Over 70% of this space was in Prague 4 and Prague 5. "Subleases are an attractive solution for companies that have more space than they actually need. These subleases are a demanded commodity. Being competitively priced and featuring finished interiors, albeit without support services, they compete with serviced offices," says Pavel Novák. Savills' autumn survey from February 2023 to September 2023 also confirmed that physical office occupancy remains at 52% since the pandemic, compared to around 70% before the pandemic.

Reconstruction

Up to 84,000 sq m of space in ten buildings will be launched to the market in 2024, six of which are reconstructions. "A good example of a successful renovation is the LIFE_Building_C building in Brumlovka. After the 2020 refurbishment, it was certified BREEAM In-Use with an Excellent rating, boasts low energy consumption and is currently 90% occupied. We want to highlight the benefits of renovating class B and C buildings, emphasizing the economic viability aligned with ESG strategies," says Pavel Novák, adding: "On the other hand, our data indicates that by 2025 the new construction volume is expected to reach its lowest point in the past decade. The newly constructed office space is unlikely to surpass 17,000 sq m. Despite this, there remains a demand for space in the market, presenting an opportunity to revamp existing office buildings in an economically sustainable manner aligned with the ESG strategy.

There are various factors contributing to the increasing interest in shared office spaces. Traditionally, these spaces were primarily sought after by individuals, freelancers, and startups. However, there's now a growing demand from larger companies with 50 to 100 employees, as well as major corporations seeking detached workplaces. Companies opting for shared offices enjoy three key advantages. Firstly, tenants are spared from making any upfront investments in the office infrastructure. Secondly, they benefit from flexible lease agreements. The third advantage is that tenants are relieved from the burden of paying for support services, as these are handled by the centre operator. Additionally, tenants avoid the unwelcome surprise of outstanding operating cost deposits, a challenge faced by many over the past twelve months. There has been a shift in the corporate mindset after the pandemic, with companies realizing that their office spaces are not as consistently occupied as they were before COVID-19. Consequently, flexible leases in serviced offices have become more acceptable for them," concludes Pavel Novák from Savills.

.jpg)

.jpg)