Quality retail and leisure can unlock hidden residential value

28 March 2019

When high quality retail and leisure combines with a short travel time to one of the city’s 10 key employment hubs, the potential for residential value uplift rises substantially.

For travel times of up to 20 minutes, comprehensive regeneration has the potential to increase existing residential values from an average of around £650 per square foot with a very poor or non-existent mix of retail and leisure outlets to £1440 where the retail and leisure offer is of the highest quality.

Where journey times to key employment hubs are between 40 and 60 minutes, the potential to unlock value is less marked, at around 14 per cent, from an average of £460 to £525 per square foot.

Researchers at Savills modelled residential values at a local level against a range of factors known to be linked to house prices. These included travel times to work, access to green space, proximity to education, quality of place, night economy offering, quality of retail and leisure, and more.

Each area (MSOA) across London was given an overall 0-36 score for retail and leisure, taking into account the quality and quantity of multiple retail brands, independent stores, restaurants and cafes, entertainment and leisure operators relative to the rest of London.

Savills identified locations where house prices are relatively low given connectivity and other quality of place measures, and mapped the potential for residential value uplift on existing values by improving the retail and leisure offering as part of a regeneration effort.

“A well-curated retail and leisure offering, when partnered with quality housing, is key to helping developers create successful mixed-use developments that are vibrant and lively places to live and work,” said Savills Research.

“When people make decisions about where to live, whether to rent or buy, they want to know how they’ll get to work, and they want to come home to a place that meets their lifestyle needs. Mixed use developers that meet these needs will create value.”

Hidden value mapped:

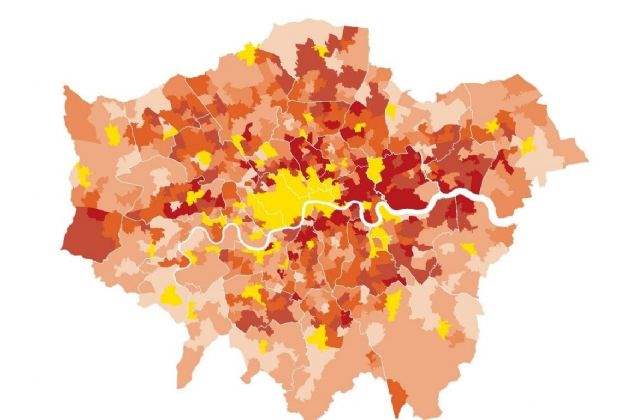

As the map below shows, at the very heart of central London the quality of retail and leisure is already very high, meaning any further improvement is unlikely to significantly impact on residential values. Other locations where the retail and leisure mix is also strong include Wimbledon, Greenwich, Blackheath and Ealing.

But as the map shows, in well-connected locations with a lack of quality retail and leisure, the potential for residential value uplift can reach over 30 per cent as part of a comprehensive regeneration. Such opportunities include: Arsenal, Finsbury Park and parts of Camden to the north; large swathes of Newham to the east, emanating from Stratford; Canada Water, Vauxhall, Elephant and Castle and north Clapham to the south of the river; and around Ealing to the west.

There is also evidence of the potential for a 20 to 30 per cent residential value uplift along the Crossrail route, to the east and west of inner London.

“Adopting a more flexible and sustainable rental approach to the ground floor retail and leisure element of a development will have valuation implications,” said Marie Hickey, director, Savills commercial research. “But, with the bulk of the value in a mixed-use scheme tied to the residential, it may generate greater and longer-term benefits.

“Flexibility is particularly crucial for early phases of multi-phase projects, and for developers who are retaining a stake in a new area, such as in the growing build to rent sector, or in large mixed-use schemes.”

Very successful models have been developed by Argent at King’s Cross, British Land at Canada Water and Stanhope at Television Centre.

Please click here to read the full report.

General Enquiries

+44 (0) 20 7016 3802