Sweden heads for record levels of investment in 2016

26 October 2016

Investment volumes into Swedish real estate are set to reach a record high of in excess of SEK 180bn this year, according to international real estate advisor Savills. The first three quarters of 2016 finished extremely strongly, with an investment turnover amounting to SEK 134bn, a yoy increase of 29%, which is in line with the all-time high recorded in the Q1-Q3 period, 2008.

Savills research shows that office properties, followed by residential properties, were the two largest sectors in terms of transaction volume during the first three quarters of 2016. The main contributor to the high transaction volume was Castellum’s acquisition of Norrporten, one of Sweden’s largest property companies, a deal amounting to SEK 22bn.

“Despite the fact that demand for commercial real estate in Sweden is far exceeding the supply coming onto the market, we expect 2016 to be a record year in terms of transaction volume,” says Peter Wiman, head of research, Savills Sweden. “Investment into commercial real estate is mainly driven by low interest rates, attractive yields and the lack of alternative investment opportunities. Brexit has led to a prolonged period of low interest rates which will continue to be very beneficial for the property market as financing costs are at historically low levels.”

Fredrik Östberg, head of investment at Savills Sweden, comments: “High demand for prime assets primarily in Stockholm, Gothenburg and Malmö has contributed to historically low yields. As a result, investors looking for higher returns have been forced to consider secondary assets and other geographical markets, such as regional cities and suburban locations in the major cities.”

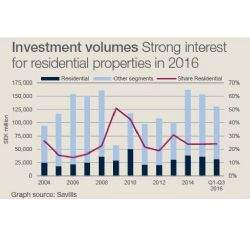

Savills also highlights that residential property in Sweden is becoming much in demand due to the country’s severe housing shortage. The investment volume in the sector amounted to SEK 32bn during the first three quarters of 2016, a 24% share of the total volume. The investment volume is 52% higher than the same period in 2015 and already in line with the annual 10- year average volume. “Market fundamentals, such as the current housing shortage in Sweden and increasing pace of construction, indicate a bright future for investment opportunities in the sector”, comments Peter Wiman. “It is being buoyed by developers selling off residential projects from production pipelines, and municipality owned housing companies disposing of assets to finance new builds and sizable renovation schemes.” Savills is expecting this increase in available product to have a significant effect on the transaction market in this sector over the coming years.

Foreign investors accounted for 14% of the total investment volume in Sweden during the first three quarters of 2016, which is significantly lower compared to 2015, when foreign investors represented 21% of the total transaction volume. Savills suggests however that the significant drop in foreign capital can to some extent be explained by the Norrporten acquisition and in fact, the level of foreign investor interest is somewhat misleading when focusing on net purchases as foreign investors have been very active as both sellers and buyers this year. The cross border volume for Q1-Q3 amounted to SEK 43bn, which was in line with the same period in 2015.